Debt Consolidation: A Solution for Managing Multiple Debts

Are multiple loan payments each month causing you to struggle? Do you feel overwhelmed by the amount of debt you’ve accumulated? If so, debt consolidation may be the solution you’ve been looking for.

Debt consolidation is the process of combining multiple debts into a single, larger loan. This means taking out a new loan to pay off all of your existing debts, leaving you with just one monthly payment to make. While this may sound counterintuitive, it can actually be a useful strategy for managing and paying off your debts.

One of the main benefits of debt consolidation is simplifying your finances. With multiple debts, it can be challenging to keep track of due dates, interest rates, and payment amounts. By consolidating your debts, you’ll only have one payment to make each month, making it easier to budget and keep track of your finances.

Another advantage of debt consolidation is the potential for a lower interest rate. If your current debts have high-interest rates, consolidating them into one loan with a lower rate could save you money in the long run. This can help to reduce the total amount you owe and make it easier to pay off your debts.

Debt consolidation can also provide some relief from the stress and anxiety that comes with managing multiple debts. Once you consolidate your debts into one monthly payment, you no longer have to worry about missing a payment or dealing with harassing phone calls from creditors. This can provide a sense of peace and help you focus on paying off your debts.

There are several methods of debt consolidation, including balance transfer credit cards, personal loans, and home equity loans. Each option has its advantages and disadvantages, so it’s essential to do your research and choose the option that best fits your financial situation.

If you have a good credit score, a balance transfer credit card could be a suitable option. Many credit cards offer an introductory 0% interest rate for a certain period, allowing you to transfer your high-interest debt and pay it off without accruing additional interest. However, be sure to check the fine print, as there may be fees associated with balance transfers.

Another option

Personal loans are another option for debt consolidation. These loans can be obtained from banks, credit unions, or online lenders. They typically have fixed interest rates, making it easier to budget for your monthly payments. However, to qualify for a personal loan, you’ll need a good credit score and a stable income.

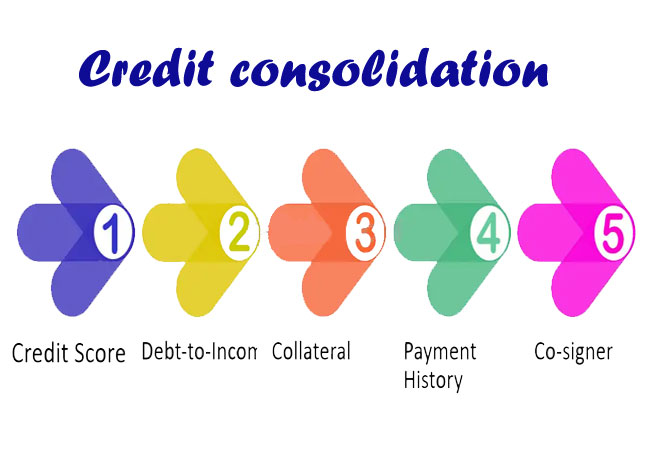

Debt consolidation involves combining multiple debts into one larger loan. These loans use your home as collateral, so they often have lower interest rates than other types of loans. However, this option should be carefully considered, as you risk losing your home if you are unable to make the payments.

In conclusion, debt consolidation can be a useful tool for managing multiple debts and getting your finances back on track. It can simplify your payments, potentially lower your interest rates, and reduce the stress of dealing with multiple creditors. However, it’s essential to carefully consider your options and choose the one that best fits your financial situation. With proper research and a solid payment plan, debt consolidation can be the first step towards a debt-free future.